Log In from Anywhere to Do Your Books

![]()

MYOB ALSO FEATURES a cloud-only accounting software program for small businesses. In this, they have identified the important features that small businesses need to be compliant — including GST, BAS and Payroll.

All of these features have been included in the neat online accounting program they call MYOB Essentials.

The MYOB Essentials program has been aimed to compete with MYOB’s rival in the accounting space, Xero, which too targets small businesses and is extremely easy to access by multiple people at once (think the office administrator, through to your business’ BAS agent, accountant and, of course, the business owner) at the same time and from anywhere.

MYOB Essentials is Packed with the Features Most Small Businesses Want and Need

MYOB Essentials has the bank feeds feature which makes data entry much easier, faster and more accurate. Also, the fact that a small business can create a quote on the spot, keep track of their quotes and then perform all the credit management tasks from invoicing, payments and reporting, means that this software is relatively low priced — yet includes the features most small businesses need.

Payroll that Pay Scales

Payroll is the module that MYOB use to scale the pricing up according to the size of the business. Our MYOB Essentials Course goes through the important aspects from awards and timesheets, to pay runs, pay slips, paying wages and payroll reporting.

Online MYOB Essentials Beginners’ Certificate Training Courses

The MYOB Essentials Beginners’ Certificate Online Training Course includes MYOB Tutor Support & a Beginners’ Certificate.

MYOB Essentials Daily Transactions Course

Included in the MYOB Essentials Daily Transactions Course is:

- MYOB Essentials 502e101 – Edit you Chart of Accounts to Suit the Business

- MYOB Essentials 502e102 – Modify your Trading Terms

- MYOB Essentials 502e201 – Create an Inventory Item

- MYOB Essentials 502e202 – Create Customer Contacts

- MYOB Essentials 502e203 – Create a Quote for a customer

- MYOB Essentials 502e204 – Enter a Sales Invoice and Apply a Payment

- MYOB Essentials 502e205 – Create an Invoice from a Quote

- MYOB Essentials 502e206 – Process and Apply a Credit Note to an Invoice

- MYOB Essentials 502e207 – Receive a part payment

- MYOB Essentials 502e208 – Receive Payment for many invoices

- MYOB Essentials 502e209 – Process an Overpayment

- MYOB Essentials 502e301 – Who owes you money

- MYOB Essentials 502e302 – Run a Sales Summary by Customer

- MYOB Essentials 502e401 – Create a Supplier Bill

- MYOB Essentials 502e402 – Pay a Bill

- MYOB Essentials 502e403 – Enter a Spend Money Transaction

Course Duration: 12 hours

MYOB Essentials Bank Reconciliation & End of Month Training Course

Data File & Loan Account

- creating a loan account in MYOB

- transfer loan funds using MYOB

- transaction details and accounts payable in MYOB

- setup accounts payable linked account using MYOB

- editing or deleting a transaction entry in MYOB

Transactions & Journal Entries

- Creating customer cards using MYOB

- creating inventory items in MYOB

- entering a sale and payment in MYOB

- spend money within MYOB

- receive money from a client using MYOB

- reconcile your cheque account to your bank statement in MYOB

Receipt Capture, Storage and Coding

How to capture receipts and tax invoices

How to capture receipts and tax invoices- Retrieving source documents

- Coding transactions

Learn more about Receipt Capture and Storage

Course Duration: 4 hours

Get Recognised, Stand Out and Succeed

Selected courses come with membership of the Bookkeeping Academy Bookkeeper Database. This includes a local area awareness profile where potential employers can make contact and be connected.

Selected courses come with membership of the Bookkeeping Academy Bookkeeper Database. This includes a local area awareness profile where potential employers can make contact and be connected.

A resume review service is also available when your course includes membership of the Bookkeeping Academy and that will help you align your resume and cover letters with your ideal job.

Learn more about the Bookkeeping Academy

MYOB Essentials Advanced Certificate Training Course

MYOB Essentials GST, Reporting, BAS and End-of-Quarter Training Course

Included in this part of the MYOB Essentials Course is:

- Learn about how GST is calculated on each sale,

- purchase, deposit and withdrawl, GST reports,

- How to complete your BAS using MYOB’s BASlink,

- Setup your BAS Info and backup the completed BAS report for that period.

- Learn about the GST and BAS reports,

- Capital Reports (Assets and Liabilities),

- Proft and Loss and Cashflow reports

Course Duration: 3 hours

MYOB Essentials Payroll Training Courses

Included in this part of the MYOB Essentials Course is:

- MYOB Essentials 505e101 – Create a New Company File

- MYOB Essentials 505e102 – Set up your Payroll

- MYOB Essentials 505e103 – Create Employee Cards

- MYOB Essentials 505e201 – Perform a Pay Run

- MYOB Essentials 505e202 – Print and Email Pay Slips to Employees

- MYOB Essentials 505e203 – Update Employee Payroll Details

- MYOB Essentials 505e301 – Print a Payroll Summary and Detailed Report

- MYOB Essentials 505e302 – Reconcile Superannuation and Wages

- MYOB Essentials 505e303 – Reconcile the PAYG Taxes

- MYOB Essentials 505e304 – Print the Payment Summaries

- MYOB Essentials 505e401 – Create a Casual Employee in MYOB Essentials

- MYOB Essentials 505e402 – Create Permanent Employees in MYOB Essentials

- MYOB Essentials 505e501 – Process a Pay Run

- MYOB Essentials 505e502 – Process Payroll with Personal Leave included

- MYOB Essentials 505e503 – View Employee Leave Accrued

- MYOB Essentials 505e504 – Process Pay including Annual Leave

- MYOB Essentials 505e601 – Run a Journal Report

- MYOB Essentials 505e602 – Produce a Balance Sheet

- MYOB Essentials 505e701 – Record your Bank Details

- MYOB Essentials 505e702 – Record Employee Bank Details

- MYOB Essentials 505e703 – Process a Pay Run and Create a Bank File

- MYOB Essentials 505e801 – Create an Earnings Category

- MYOB Essentials 505e802 – Process Final Pay

- MYOB Essentials 505e803 – Update Employee Records

Course Duration: 5 hours

Real World Case Studies

We design our accounting courses around scenarios that occur in real businesses and in our Payroll Administration Courses these include a hair dressing salon and the advanced Payroll course centres around the staff and payroll management of a chicken shop.

We design our accounting courses around scenarios that occur in real businesses and in our Payroll Administration Courses these include a hair dressing salon and the advanced Payroll course centres around the staff and payroll management of a chicken shop.

Learn more about our Payroll Administration Course Case Studies

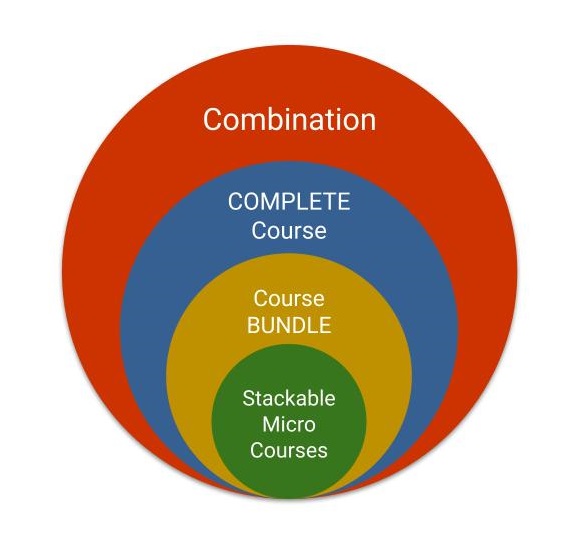

Enrolling Separately into Courses

Remember: We now offer a training course package which includes both the MYOB AccountRight COMPLETE courses, AND the MYOB Essentials COMPLETE Courses.

Remember: We now offer a training course package which includes both the MYOB AccountRight COMPLETE courses, AND the MYOB Essentials COMPLETE Courses.

If, however, you only want to enrol into the MYOB Essentials Courses you can do that too. See the details at the Bookkeeper Course Catalogue.

Why Choose EzyLearn?

Student Testimonials from All Over Australia:

See testimonials and feedback from your local area and more specifically in your local state:

- Queensland

- Victoria

- New South Wales

- Western Australia

- South Australia

- Tasmania

- Northern Territory

- Tasmania

Also read about how we have evolved since 1996.

Training Inquiry

Get the right training for your needs

We work remotely from home and we’d like to help you.

We work remotely from home and we’d like to help you.