Beginners Training Course in Payroll using MYOB, Xero and QuickBooks

In the Level 1 Payroll training course you’re introduced to the staff at Trim and Styles Hairdressing Salon. Rick Peterson runs a business hairdressing salon and you’ll perform the data entry and transactions to get into the accounting software, create employee profiles, establish pay calendars and make sure that the staff are paid every pay cycle.

The business is very busy so they have mainly full-time permanent staff but then a new employee came along to fill in the gaps on Thursday nights and Saturdays and suggested that they start a social club. You’ll perform all the data entry to ensure that every staff member is paid correctly and provided with a pay slip. You’ll also produce reports that reconcile the PAYG liabilities and confirm that the correct payments and deductions are made so that Rick and his team can work and socialise harmoniously.

Employment and Payroll is a significant cost for most businesses and hiring the right team and keeping them happy can make a big difference to how the business performs. An employees wages plays a critical part of a persons income and financial well being so it’s important to get it right.

Employment, Wages and Superannuation is regulated to ensure that all the data entered is correct and current and ensures that the Australian Taxation Office receive the correct amount of tax on behalf of your employees.

Introduction to Payroll Dashboard and Staff

You’ll learn how to navigate to the Payroll Administration Dashboard as well as the rudimentary requirements for your main staff members, including the Superannuation Guarantee and withholding payments for tax.

This includes:

- Organisation details

- Payroll Accounts

- Pay items

- Ordinary Time Earnings

- Superannuation

- Tax Free Threshold

- Pay Calendars

- Employees

Setting Up Employees and Paying Wages

You’ll be provided with the pay rates and status of all the employees or Trim and Styles and enter them into the Accounting software according to the pay calendar. You’ll see and learn about:

- Permanent or Part-time employees

- Start dates

- Salary as annual rates or hourly rate

- Superannuation Guarantee

- Tax File Number

- Reporting as W1 on the BAS activity statement

Pay Runs and Pay Slips

With everything setup and employee data entered into the system you’ll learn how to perform a payrun and statutory requirements relating to pay slips and notifying employees. You’ll

- produce Payroll Activity Reports and see

- Wages,

- Pay rates,

- PAYG,

- Super and

- Net Pay

New Employees and Extra Pay Items

Staff are hired and fired and employees change regularly for lots of reasons. You’ll learn how to introduce new pay items because all the staff agree it would be good to have a social club and fund it with extra money in their wages. The boss, Rick, is a very social man so he loves the idea and his team!

You’ll learn

- how to add Pay items in the business settings

- Gross Salary Sacrifice for voluntary contributions

- BAS reporting for the social club in W1

- How to edit a pay run, revert to draft and run a new pay run

Reporting and Reconciling

Reconciling your payroll confirms that all the information has been entered correctly. You’ll explore numerous reports to confirm that the details you entered are correct and reflected in the businesses P&L and Balance sheet reports. You’ll learn:

- How to produce Payroll Activity Summaries

- Employee Summaries

- Deductions

- Reconcile PAYG liabilities to Balance Sheet

- Reconcile wage payments to P&L

- Print Summaries

- EOFY Procedures

- Introduction to STP (Single Touch Payroll Finalisation)

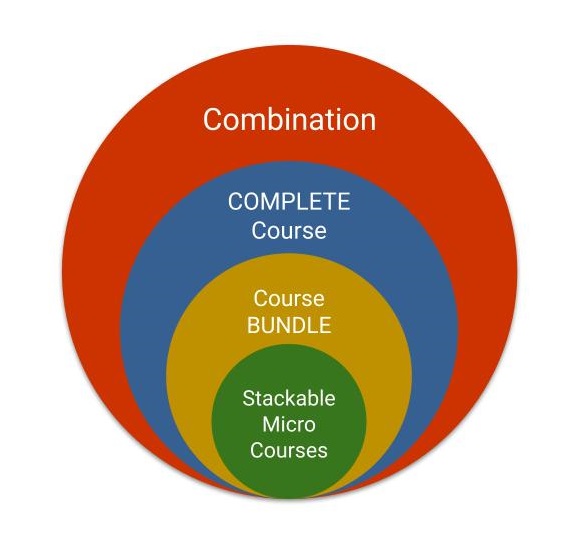

Next: Advanced Certificate in Payroll using QuickBooks, MYOB and Xero

Now that you understand the basics of payroll administration in Australia you’ll explore some more complex transactions involving a busier workplace where things change more frequently, including staff turnover and terminations.

Back to Payroll Training Course Information Page

Training Inquiry

Get the right training for your needs

We work remotely from home and we’d like to help you.

We work remotely from home and we’d like to help you.