Bookkeeping Basics Training Course Package using in Xero, MYOB & QuickBooks

This Accounting and Bookkeeping Basics Training Course includes training on how to perform common tasks using all three major Australian accounting programs:

- MYOB Business (Business Lite/Pro

- MYOB AccountRight

- Xero Accounting, and

- Intuit QuickBooks Online

4 hours (4 CPD Points) of training course exercises and assessments. You’ll be assessed and receive a Beginners Certificate of Bookkeeping.

What’s included in the Bookkeeping Basics Training Course?

This course consists of sixteen sections, that range from an introduction to bookkeeping terms all the way through to performing pay runs in different accounting software. Some sections are longer than others, and some with subsections, but all contain the vital information you need to understand the fundamentals of bookkeeping using the leading accounting software programs: Xero, MYOB and QuickBooks Online.

The main sections covered are:

- Introduction

- Accounting Terms

- Chart of Accounts

- Goods & Services Tax (GST)

- Tax Codes

- Cash Vs. Accrual Accounting Methods

- Debits-Credits-Income-Expenses

- Introduction to Credit Control

- Bookkeeping Basics Guide

- Accounting software

- Chart of Accounts

Perform Basic Bookkeeping Functions

Whether you use Xero, MYOB AccountRight, MYOB Business (Lite or Pro), QuickBooks Online – or you if you want to become familiar with multiple accounting programs to improve your chance as a jobseeker – you’ll find the training you need in this course.

- Invoicing and Accounts Receivable

- Purchases and Accounts Payable

- End of Month Bank Reconciliation

- Business Reports

- Payroll Introduction

Invoices and Purchases

You’ll learn about Chart of Accounts, Purchases, and Sales areas, and some of the reports that your software can generate. These reports include Accounts Payable and Accounts Receivable and why it is important to have good credit management to ensure the bills from suppliers are paid on time and how to keep track of money owed to the business.

End of Month Bank Reconciliation

Learn how to navigate to the Bank Reconciliation sections of QuickBooks, MYOB & Xero and understand the important concepts to make sure your accounting software matches the transactions on your bank statement. All accounting programs now offer bank feeds which reduce the amount of time it takes to have accurate transaction data for the business.

Payroll Training

Get an introduction to payroll and learn the fundamental stages and tasks from creating new employee cards to performing a pay run.

You’ll get an introduction to these common bookkeeping tasks using the major Australian accounting programs.

Accounting Terms and Meanings

Even if you have no knowledge of bookkeeping the Bookkeeping Basics Training Course gives yous an introduction to what bookkeeping is and the definitions of some key accounting terms, from “accrual accounting” to “year-end”.

You’ll learn about relationships between these terms, such as how the Chart of Accounts, General Ledger, and Trial Balance relate to each other.

Reporting and Tax Obligations

One of the more confusing, yet important parts of bookkeeping is tax obligations. Since reporting obligations and frequency depends on the business’ turnover, it’s essential to know whether you need to be registered for GST, and how this will impact your tax invoices.

One of the more confusing, yet important parts of bookkeeping is tax obligations. Since reporting obligations and frequency depends on the business’ turnover, it’s essential to know whether you need to be registered for GST, and how this will impact your tax invoices.

Other reporting aspects you’ll learn include how the Cash and Accrual accounting Methods impact BAS, what income and expense types to report the ATO, Journal Entries, and debits and credits

You’ll learn about tax codes too, like FRE and N-T, and how these apply to purchases and to help you perform the data entry for coding transactions to complete your bank reconciliation accurately.

You’ll Learn about the Balance Sheet and Profit and Loss Reports.

Credit Management

Credit control and the cash conversion cycle are important fundamentals of business that you’ll learn how to understand and interpret. Accounts Payable and Accounts Receivable show you the money that the business owes and the money that is owed to it.

Credit control and the cash conversion cycle are important fundamentals of business that you’ll learn how to understand and interpret. Accounts Payable and Accounts Receivable show you the money that the business owes and the money that is owed to it.

Learn about the benefits of receiving payment from clients quickly and paying suppliers according to their terms of trade to have a well running accounting department. You’ll learn and understand how this relates to improved cash flow and overall business performance.

Having covered the fundamentals of bookkeeping, the Bookkeeping Basics Training Course also includes an introduction to implementing these skills in your accounting software.

Training Manual in PDF Format Included

The Bookkeeping Basics Certificate training course includes a downloadable PDF training guide that shows all the written content and diagrams from the modules, so you can easily refer to it as a resource throughout your course and in the future as a refresher.

Basic Bookkeeping Certificate Included

Successful completion of this course includes a Basic Bookkeeping Certificate from the Bookkeeping Academy that you can use to demonstrate your competency.

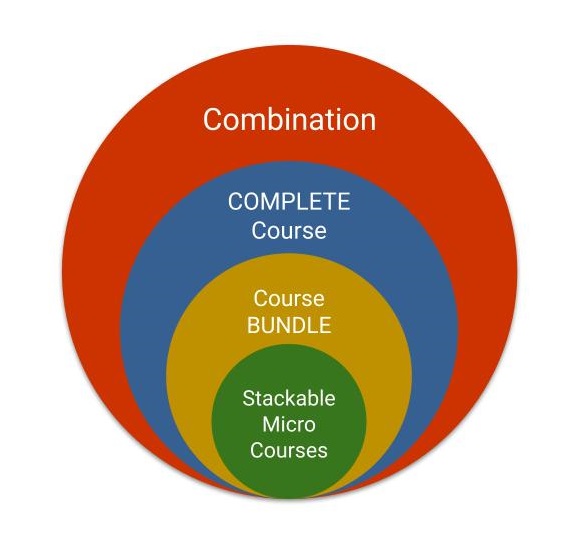

Training Inquiry

Get the right training for your needs

We work remotely from home and we’d like to help you.

We work remotely from home and we’d like to help you.