Income Sources

Knowing your financial situation is critical in times of high interest rates and inflation or if you lose your job and the best way to do this is with a personal or household budget. Your household budget should include all income sources such as:

Knowing your financial situation is critical in times of high interest rates and inflation or if you lose your job and the best way to do this is with a personal or household budget. Your household budget should include all income sources such as:

- interest payments,

- dividends,

- wages

- rental income

- side hustle

It is now easier to earn an extra income by providing Gig Economy services and selling things online and having a good snapshot of your total income can help you make decisions about how to increase your income.

Expenses and Spending

Your household and person expenses should also be listed so you can come up with a NETT “profit and loss” statement. Typical household expenses include:

Your household and person expenses should also be listed so you can come up with a NETT “profit and loss” statement. Typical household expenses include:

- mortgage repayments

- power

- water

- rates

- petrol

- food

- insurances

- car repayments

- internet

- phone

- lifestyle purchases

- eating out

Using a Spreadsheet

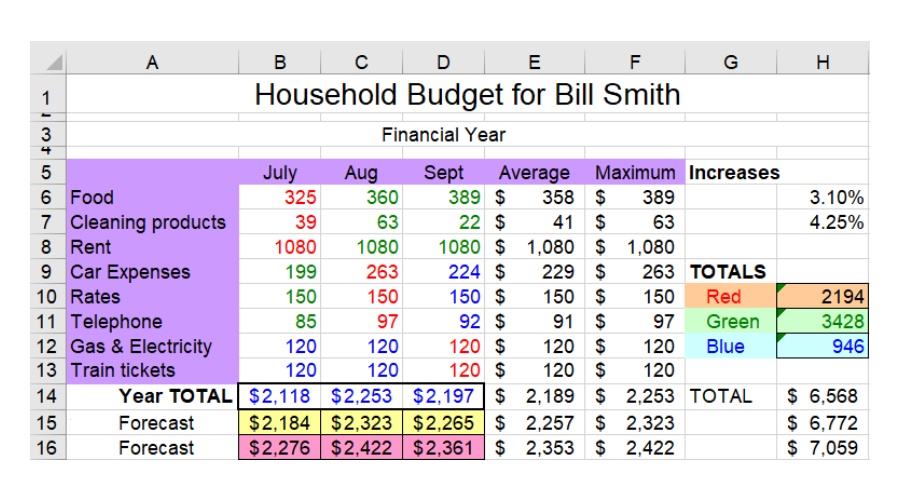

Entering your information into a spreadsheet is the start of a process of “empowering” that enables you to see things clearly and unemotionally. With the raw data in front of you decision making is more of a discussion about things you can do to increase income and reduce expenses.

If your expenses comprise of repayments that are dependent on interest rates you can explore ways of reducing these high costs. Consolidating all of your debts at a low interest rate is one way that you can save a lot of money and use your existing debt arrangements. If you are paying high interest rates on credit card purchases or car loan repayments you can consolidate them at a much lower interest rate that you have on your household mortgage.

Setting Some Limits

With your financial information displayed clearly in a spreadsheet like Microsoft Excel enables you to set yourself some limits and goals. One of the reasons that people get out of control in debt is because they don’t really know their limits and what they can afford to spend.

Because most interest rates a variable your financial situation can change from month to month and all of a sudden things can get out of hand. It’s best to know where you stand and make objective (unemotional) decisions to make sure that your head is always above water.

Master Excel Spreadsheets

Mastering the use of Microsoft Excel for your own personal and household budgets is very useful and the skills can also help you become more valuable where you work. The finances of a business are usually far more complex and cashflow varies so using a spreadsheet for a business is almost a MUST HAVE.

See what’s included in the Intermediate Excel Training Courses

[gravityform id=”1″ title=”true” description=”true”]

See blog articles relating to household and personal budgets using Microsoft Excel

We work remotely from home and we’d like to help you.

We work remotely from home and we’d like to help you.