The process of moving from one software program to another is called Migrating and the process essentially involves the following steps:

- Choosing a date that the official migration data is to occur

- Export all of the data from the old software

- Match fields for the program you want to begin using

- Import all of the transactions and data

- Set opening balances

- Enter transaction from the start date until today’s date

Chard of Accounts (General Ledger) Codes, Purchases (Bills), Invoices, Contacts and Suppliers. Although templates are available to upload directly, requirements vary so decisions may need to be made on exactly what’s required.

GL Opening Balances

Opening balances from your General Ledge should be loaded as at the conversion date and that requires the balances to be checked and accurate which might not be available until financial reports are prepared after the year end depending on the size of the business.

This is a good time to review General Ledger codes and deleted or combine codes while you review how you record your data – after all you won’t be making changes like this for a while. Most accounting software companies offer account code mapping templates to help make the transition easier, faster and cheaper. It also means that although your General Ledger codes might be different from other business, your accountant gets data that they understand and can work with right away.

Accounts Payable and Receivable

Your Accounts Receivable (AR) and Accounts Payable (AP) records need to be accurate as of the date of conversion. Many AR and AP records are out of date or need correcting so it is important to do this before you export and migrate your accounting data.

If you have a large volume of open invoices or bills to migrate across it may be more prudent to cash code some of the records rather than import but whatever decision you make it should be noted down and very clear how the data will be treated during the transition period. Remember that this will affect how you search for and find this historical data in the future when you need to.

Accounts Receivable must match all invoices owing and Accounts Payable must match all bills owing and softwre vendors create templates to help you match and upload outstanding invoices and purchases (bills).

Bank Accounts

You’ll need to setup a bank feed set up for every bank account, overdraft or credit card that is included in the company accounts and because bank use different methods for setting up bank feeds it can take up to 10 working days to finalise this (sometimes they even require written authorisation) so request bank feeds as soon as practical.

Bank accounts need to be set up in system you are migrating to first, and then the form downloaded / signed / uploaded. Some banks allow bank feeds to be set up from within Internet Banking and how this works changes from bank to bank and accounting software to accounting software although you might fill in the form within one accounting program you might find that your bank required you to set up the bank feed directly through internet banking.

If you are using a personal bank account for some of your business expenses this is a VERY good time to separate bank accounts for personal v. business because if an account is being used for both personal and business expenses it might take longer to reconcile and harder for your bookkeeper because they’ll need to sit down with you to understand which transactions are for business and which ones for personal use.

Suppliers and Batch Payments

Importing suppliers into your accounting software enables you to use the batch payment function to pay your bills if available. This can save a lot of time when it comes to reconciling because it’s one payment transaction as opposed to trying to match each payment individually.

Some banks have batch payments through normal internet banking while others require you to set up a Business Banking. The advantage of having the Business Banking login is that you can customise the authority you assign to different users – perhaps one person only can load batches, while you have authority to check and approve.

Contacts

Importing contacts into accounting software is easy, ensuring your data is clean is a whole different matter. Like most aspects of a migration this is a fantastic time to clean your database by deleting old data unwanted data, updating records, but most importantly making sure the data is in the correct columns ready for import.

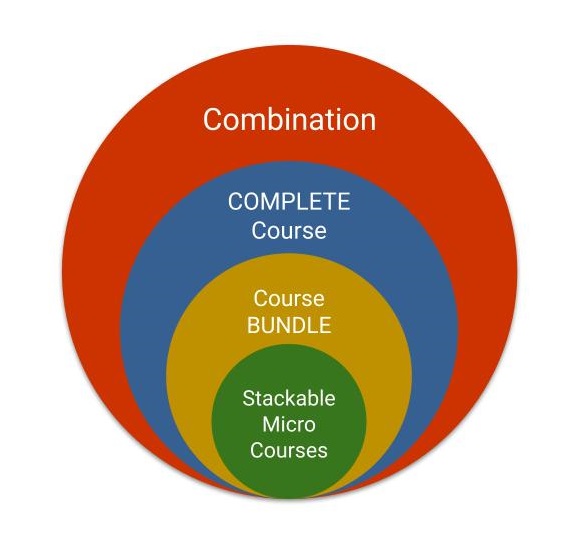

Integrations & Advanced Features

Most cloud-based applications have a strong integration marketplace that enables you to use the accounting software for financial transactions, project tracking software like WorkflowMax for job management and CRM software to manage new leads. If your clients are small all of these contacts may be the same but if you supply products and services to corporate or government clients each one might be different.

If you’re business does then you’ll need to identify the different types of contacts used in each of these separate systems. You might also need to consider where to keep your data and who can access each system and why they need the access.

We work remotely from home and we’d like to help you.

We work remotely from home and we’d like to help you.